MetaVolttrade Group

The future of money is here.

Spend, save, invest and manage your money, all in one place. Open a full multi asset account from your phone, for free..

12M+

Over 12M+ investors worldwide trust our platform to trade in stocks, forex, crypto, and commodities. With reliable tools and secure systems, we empower traders to grow wealth and achieve financial freedom. .

0%

We believe you should keep more of what you earn. That’s why we proudly offer 0% commission on selected trades—helping you maximize your profits, reduce costs, and reinvest more into your financial journey.

about us

Built on trust and robust protection

With 10 years of trusted, regulated service, Meta Voltrade Investment provides a secure trading environment. Client funds are fully segregated and held by independent banks, backed by solid institutional expertise and a commitment to your security.

Regulatory Compliance

Licensed by the International Financial Services Commission, we follow strict regulatory requirements, ensuring integrity in every trade.

Capital Protection

Client funds are fully segregated and held in dedicated accounts, providing secure and transparent protection.

proven track record

Our proven track record highlights successful outcomes and client satisfaction through effective financial solutions.

our services

Expert financial services for your needs

Our expert financial services are tailored to meet your unique needs, providing guidance and strategies for informed decision-making and growth.

Strategic Business Consulting for Growth Success

Comprehensive Financial Planning for Your Future

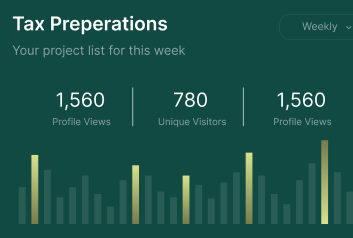

Expert Tax Preparation for Maximum Savings

our expertise

Driving innovation and success in Industry Insights

Our expert consultants bring a wealth of experience to the table, offering actionable solutions that enhance business performance, streamline operations, and foster long-term growth.

Benefits of our financial:

Empower your financial journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

Benefits of our business:

Empower your business journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

Benefits of our risk:

Empower your risk journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

Benefits of our investment:

Empower your investment journey with expert advice, personalized strategies, and solutions designed to help you achieve long-term stability, growth, and peace of mind.

expert nvestment management

Social Security and Pension Optimization

business financial planning

why choose us

Expertise and client focused solutions for your success

Our team of experienced professionals delivers personalized, results-driven financial strategies tailored to your unique goals. We prioritize transparency, trust, and long-term success.

our approach

Client centric strategy for lasting success

We believe that a successful financial journey starts with understanding your unique needs and aspirations Our approach is built on a foundation of collaboration, transparency, and expertise.

financial wisdom

Fascinating facts that shape your financial knowledge

Explore fun and surprising facts about the financial world. Learn how history, trends, and innovations have shaped today's finance landscape, making it easier to navigate your financial journey.

The number of publicly traded companies

12k+

The percentage of financial advisors

80%

The number of credit cards in circulation

31k+

The proportion of Americans who believe that financial literacy

90%

key features

Innovative solutions elevate your financial experience

personalized financial planning

Crafting tailored strategies to align with individual financial objectives.

expert investment management

Professional oversight to optimize investment portfolios for growth and risk mitigation.

real estate investment advice

Guidance on property investments for income generation and capital appreciation.

key pricing

Customized pricing plans for every budget and goal

Discover our competitive pricing structure designed to provide accessible financial services without compromising quality. Empower your financial future today.

BASIC PLAN

20% per trade

A flexible plan tailored to your needs.

- Principal return on maturity

- Instant Withdrawal

- Professional Charts

- 24/7 Support

- Min: $50.00

- Max: $1,000.00

STANDARD PLAN

30% per trade

A flexible plan tailored to your needs.

- Principal return on maturity

- Instant Withdrawal

- Professional Charts

- 24/7 Support

- Min: $1,000.00

- Max: $5,000.00

SILVER PLAN

50% per trade

A flexible plan tailored to your needs.

- Principal return on maturity

- Instant Withdrawal

- Professional Charts

- 24/7 Support

- Min: $5,000.00

- Max: $20,000.00

VIP PLAN

70% per trade

A flexible plan tailored to your needs.

- Principal return on maturity

- Instant Withdrawal

- Professional Charts

- 24/7 Support

- Min: $20,000.00

- Max: $50,000.00

Wealth building for tomorrow.

Take control of your financial future today!

Start your journey toward financial success with expert guidance and personalized solutions. Secure your future with confidence.

testimonial

Genuine reviews from satisfied customers

12k+

The first credit card ever issued was made of cardboard and was introduced.

0%

we believe that you should keep more of what you earn.

frequently asked questions

Common business & finance questions and answers

How do I create a budget for my business?

To create a business budget, start by estimating your income and listing all fixed and variable expenses. Subtract expenses from income.

What is cash flow, and why is it important?

Cash flow refers to the movement of money in and out of your business. Positive cash flow ensures you can cover operational costs.

How can I improve my business's financial stability?

Build financial stability by maintaining a strong cash reserve, cutting unnecessary costs, managing debt carefully.

What financial metrics should I track regularly?

Key financial metrics include net profit margin, cash flow, operating expenses, debt-to-equity ratio, and return on investment (ROI).

How often should I review my business budget?

You should review your budget monthly or quarterly to ensure you're on track with projections. Regular reviews help.

What are the benefits of using financial technology?

FinTech solutions can streamline financial operations through automation, improve data accuracy, enhance decision-making.

latest Post

Top Strategies to Boost Your Business Financial Growth

Discover effective strategies to enhance your business's financial growth. From smart budgeting to investment tips, this post covers essential insights to help you improve profitability and achieve long-term success.